|

Getting your Trinity Audio player ready...

|

The challenges facing Intel at the moment has been outlined by the interim CEOs currently heading up the troubled firm, after the shock ousting of Pat Geslinger.

Reuters reported that interim co-CEOs Michelle Johnston Holthaus and David Zinsner have conceded on Thursday that the company may be forced to sell its manufacturing operations if a new chip-making technology slated for next year does not succeed.

As part of its stuttering turnaround plan, Intel had confirmed in September that the firm plans “to establish Intel Foundry as an independent subsidiary inside of Intel.”

Intel Foundry

But the Intel Foundry spin-off was thrust in doubt after the Biden administration finalised an award of $7.86 billion (£6.27bn) in federal funding under the Chips and Science Act.

This was to advance Intel’s manufacturing and semiconductor packaging projects in Arizona, New Mexico, Ohio and Oregon.

Then Intel in a filing revealed that the $7.86 billion government subsidies, would restrict it’s ability to sell stakes in its chip-making unit if it became an independent entity.

And if Intel Foundry became a public company and Intel itself was not the largest shareholder, the company could sell only 35 percent of Intel Foundry to any single shareholder before running into change-in-control provisions.

Open question

And now Reuters reported on comments made by interim CEOs Michelle Johnston Holthaus and David Zinsner, when speaking at a Barclays investment banking conference in San Francisco on Thursday.

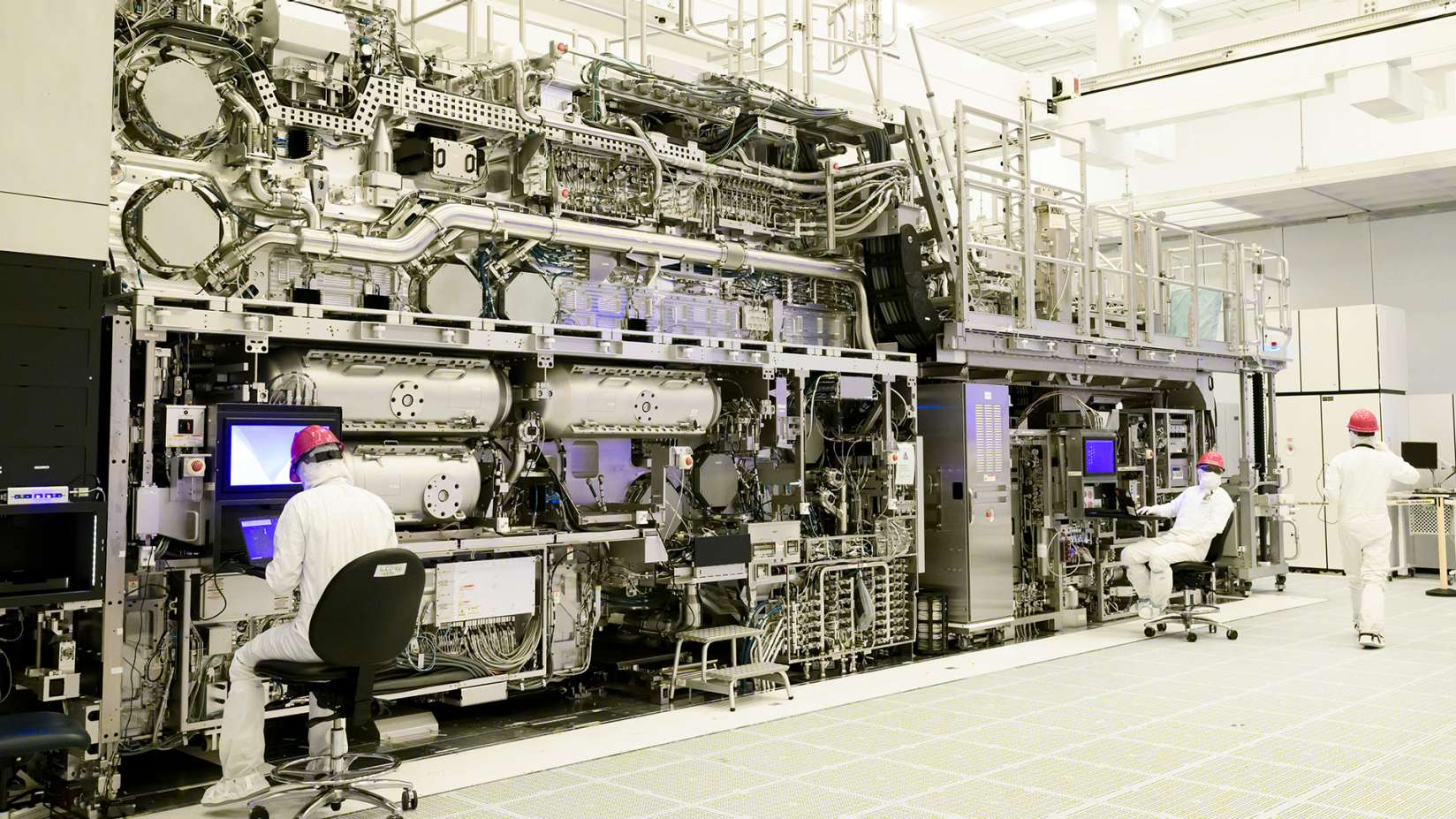

Both were reportedly asked if the company’s continued combination of manufacturing and design was tied to the success of a new chip-making technology called 18A due next year.

Chief Financial Officer Dave Zinsner reportedly said that a formal separation of the company’s factory and product-development divisions is an open question that will be decided by the chipmaker’s next leader.

The next CEO at Intel could be forced to make dramatic decisions, as Intel is unique in the industry as it both designs and manufactures chips.

One of the most pressing issues facing the new CEO would be deciding whether to split the company’s manufacturing and product-design operations.

“That’s an open question for another day,” Zinsner reportedly said in response to an analyst question.

The two units are already separated operationally, with different oversight and accounts, he said.

Former CEO Pat Gelsinge had maintained that the two main parts of the company were better kept together.

Production tech

Meanwhile the other co-CEO, Michelle Johnston Holthaus, reportedly said that access to leading production technology is an advantage for Intel’s products.

“So pragmatically, do I think it makes sense that they’re completely separated and there’s no ties?” she was quoted as saying. “I don’t think so, but someone will decide that.”

Reuters noted that tThe executives broke with their predecessor’s more bullish messaging and emphasised that it will take time to fix Intel’s competitiveness and finances. They pointed to progress in personal computer chips but also struggles ahead in data centre products.

Intel’s outsourced manufacturing effort, which involves making chips for outside clients, is another challenge.

Management will focus less on talking about “early indications of success” and more on concrete achievements, Zinsner reportedly said. They also will dispense with giving “meaningless” long-term total deal value predictions for the company’s outsourced production efforts, he added.

Johnston Holthaus meanwhile reportedly said that Intel needs to invest more in its products and is willing to deal with near-term down years to make sure it has offerings that will be more competitive in the long run.

Johnston Holthaus also reportedly said that rival Advanced Micro Devices has done a better job of providing their shared customers with data centre products they want.

In 2025, the executive will focus on trying to halt the market-share loss that Intel has suffered, she was quoted by Reuters as saying.