Nerdy Inc. (NYSE: NRDY) today announced financial results for the fourth quarter and year ended December 31, 2023.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240227127633/en/

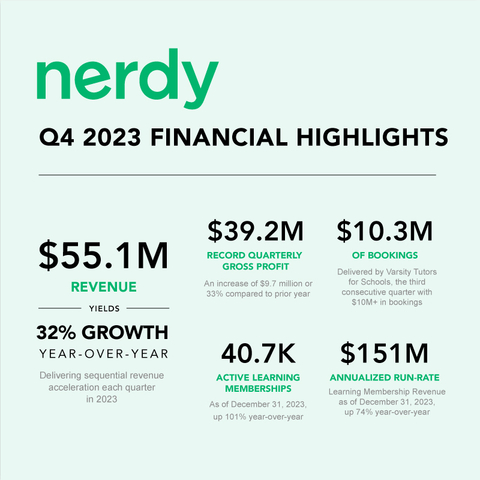

Nerdy Q4 2023 Financial Highlights (Graphic: Business Wire)

“In the fourth quarter, we completed the evolution to access-based subscription products in our Consumer and Institutional businesses, while delivering accelerating revenue growth each quarter throughout the year that culminated in 32% year-over-year growth in the fourth quarter, and 19% year-over-year growth for the full year. Our business model changes delivered substantial operating leverage, achieving adjusted EBITDA profitability in the fourth quarter of $3.0 million, and full-year adjusted EBITDA improvements of $33.2 million and approximately 2,100 bps year-over-year,” said Chuck Cohn, Founder, Chairman and Chief Executive Officer of Nerdy Inc. “We’ve made great progress evolving and enhancing our Consumer and Institutional business models and products to position Nerdy for accelerating revenue growth and adjusted EBITDA profitability for the full-year in 2024. We look forward to continuing to push the pace of innovation, including with the introduction of freemium models for both Consumer and Institutional, and continuing to elevate and enhance our ability to meet the needs of Learners in any subject, anywhere, and at any time.”

Please visit the Nerdy investor relations website https://www.nerdy.com/investors to view the Nerdy Q4 Shareholder Letter on the Quarterly Results Page.

Financial and Operating Highlights

- Revenue Growth Accelerates Each Quarter in 2023 – In the fourth quarter, Nerdy delivered revenue of $55.1 million, an increase of 32% year-over-year from $41.8 million during the same period in 2022, delivering accelerating sequential revenue growth each quarter in 2023. Revenue growth was driven by the completion of our evolution to ‘Always On’ recurring revenue products, strong adoption of Learning Memberships and lifetime value expansion in our Consumer business coupled with the continued scaling of our Institutional business.

- Membership Evolution Complete – Nearly 100% of Consumer revenues were from Learning Memberships. Revenue recognized in the fourth quarter from Learning Memberships grew to $43.5 million (sequentially up 32% from Q3 2023) and represented 79% of total Company revenue. Active Members of 40.7K as of December 31, 2023 were up 101% year-over-year.

- Institutional Business Delivers Substantial Growth – In the fourth quarter, Institutional revenue of $11.3 million increased 160% year-over-year and represented 21% of total revenue. Varsity Tutors for Schools executed 42 contracts, yielding $10.3 million of bookings, the third consecutive quarter with more than $10.0 million of bookings.

- Record Quarterly Gross Profit – Gross profit of $39.2 million in the fourth quarter increased 33% year-over-year. Gross margin of 71.3% for the three months ended December 31, 2023, was 75 bps higher than gross margin of 70.5% during the comparable period in 2022. Gross profit and gross margin increases were primarily driven by growth in our Consumer business as a result of the strong adoption of Learning Memberships, which has led to lifetime value expansion, and higher gross margin.

- Business Model Changes Deliver Operating Leverage – Net loss was $9.2 million in the fourth quarter versus a net loss of $15.1 million during the same period in 2022. Excluding non-cash stock compensation expenses, restructuring costs, and mark-to-market derivative adjustments, non-GAAP adjusted net earnings were $2.2 million for the fourth quarter of 2023 compared to a non-GAAP adjusted net loss of $(6.8) million in the fourth quarter of 2022. We reported non-GAAP adjusted EBITDA of $3.0 million, above our guidance of breakeven non-GAAP adjusted EBITDA. This compares to a non-GAAP adjusted EBITDA loss of $5.5 million in the same period one year ago. Fourth quarter non-GAAP adjusted EBITDA and non-GAAP adjusted EBITDA margin improvements of approximately 1,900 bps year-over-year were driven by higher revenues, sales and marketing efficiency gains, continued variable labor productivity improvements stemming from automation and AI enabled efficiency efforts, and our business model changes that streamline operations.

- Operating Cash Flow and Liquidity – Negative operating cash flow of $5.0 million in the fourth quarter of 2023 compared to negative operating cash flow of $14.5 million last year, an improvement of $9.5 million that reflects the substantial improvements from our evolution to Learning Memberships and the substantial growth in our Institutional business, partially offset by seasonal changes in working capital. With no debt and $74.8 million of cash on our balance sheet, we believe we have ample liquidity to fund the business and pursue growth initiatives.

-

First Quarter and Full Year 2024 Outlook – Today, we are introducing guidance for the first quarter and full year.

– Revenue Guidance: For the first quarter of 2024, we expect revenue in a range of $51 to 53 million. For the full year, we expect revenue in a range of $232 to $246 million; representing accelerating year-over-year growth of 24% at the midpoint vs. our 2023 revenue of $193 million.

– Non-GAAP Adjusted EBITDA Guidance: For the first quarter of 2024, we expect adjusted EBITDA in a range of negative $3 million to breakeven. For the full year, we expect adjusted EBITDA in a range of positive $5 to $15 million, an improvement of over 500 basis points in adjusted EBITDA margin at the midpoint. We also expect to deliver positive operating cash flow in 2024.

Webcast and Earnings Conference Call

Nerdy’s management will host a conference call and webcast today, February 27, 2024 at 5:00 p.m. Eastern Time. Interested parties in the U.S. may listen to the call by dialing 1-833-470-1428. International callers can dial 1-404-975-4839. The Access Code is 001617. A live webcast of the call will also be available on Nerdy’s investor relations website at https://www.nerdy.com/investors. A replay of the webcast will be available on Nerdy’s website for one year following the event and a telephonic replay of the call will be available until March 5, 2024 by dialing 1-866-813-9403 from the U.S. or 1-929-458-6194 from all other locations, and entering the Access Code: 468650.

About Nerdy Inc.

Nerdy (NYSE: NRDY) is a leading platform for live online learning, with a mission to transform the way people learn through technology. The Company’s purpose-built proprietary platform leverages technology, including AI, to connect learners of all ages to experts, delivering superior value on both sides of the network. Nerdy’s comprehensive learning destination provides learning experiences across thousands of subjects and multiple formats—including Learning Memberships, one-on-one instruction, small group tutoring, large format classes, and adaptive assessments. Nerdy’s flagship business, Varsity Tutors, is one of the nation’s largest platforms for live online tutoring and classes. Its solutions are available directly to students and consumers, as well as through schools and other institutions. Learn more about Nerdy at https://www.nerdy.com.

Forward-looking Statements

The information included herein and in any oral statements made in connection herewith may include “forward looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions, or strategies regarding the future, including our expectations with respect to: the guidance with respect to our financial performance; continued improvements in sales and marketing leverage; the growth of our Institutional business; simplifying our operations model while growing our business; and the sufficiency of our cash to fund future operations. Additionally, any statements that refer to projections, forecasts, or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,” “approximately,” “believes,” “contemplates,” “continues,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “outlook,” “plans,” “possible,” “potential,” “predicts,” “projects,” “should,” “seeks,” “will,” “would,” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements made herein relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of this press release or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements.

There are a significant number of factors that could cause actual results to differ materially from statements made herein or in connection herewith, including but not limited to, our limited operating history, which makes it difficult to predict our future financial and operating results; our history of net losses; risks associated with our ability to acquire and retain customers in our Consumer business; risks associated with scaling up our Institutional business, risks associated with our intellectual property, including claims that we infringe on a third-party’s intellectual property rights; risks associated with our classification of some individuals and entities we contract with as independent contractors; risks associated with the liquidity and trading of our securities; risks associated with payments that we may be required to make under the tax receivable agreement; litigation, regulatory and reputational risks arising from the fact that many of our Learners are minors; changes in applicable law or regulation; the possibility of cyber-related incidents and their related impacts on our business and results of operations; the possibility that we may be adversely affected by other economic, business, and/or competitive factors; and risks associated with managing our rapid growth. Our actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to, risks detailed in our filings with the SEC, including our Annual Report on Form 10-K filed on February 27, 2024, as well as other filings that we may make from time to time with the SEC.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240227127633/en/