Forge Global Holdings, Inc. (“Forge,” or the “Company”) (NYSE: FRGE), a leading private market platform, has identified the Private Magnificent 7, which comprises seven of the largest, most resilient, and highest-performing companies in the U.S. innovation economy. Much like their public market counterparts, this diverse group of late-stage, venture-backed companies has demonstrated both superior growth and remarkable resilience throughout the recent market cycle, including the Great Reset, a period of significant valuation contraction that characterized the post-peak period of the last 2.5 years. The Private Magnificent 7 includes SpaceX, OpenAI, Stripe, Databricks, Fanatics, Scale AI, and Rippling, spanning multiple sectors including: AI, Aerospace, Fintech, Consumer & Lifestyle, and Enterprise Software.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240911178458/en/

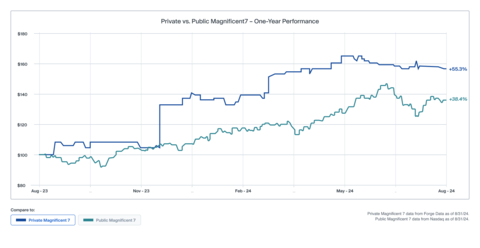

Private vs. Public Magnificent 7 – One-Year Performance (Graphic: Business Wire)

“While the post-2021 market downturn was undoubtedly a challenging period for the private market, the Private Magnificent 7 proved resilient,” said Kelly Rodriques, CEO of Forge Global. “Forge believes these companies reflect the current and emerging themes of private investing and are driving the secular growth of the U.S. innovation economy.”

The Private Magnificent 7 collectively account for $473 billion in implied valuation, based on Forge data – 30x smaller than the Public Magnificent 7, which is now roughly the equal to the size of Japan, Canada, and the U.K.’s stock markets combined1.

Though smaller in size, the Private Magnificent 7 has outperformed2 its public market counterpart by 16.9% in the 12-month period ending August 31, 2024. The select group’s price performance rose 55.3%, and in comparison, the public Magnificent 7 rose 38.4% in the same period3. While the sector compositions are different between the Public and Private Magnificent 7, Artificial Intelligence as a secular growth trend is reflected in both cohorts.

Forge operates a leading platform for private market trading and data intelligence. This includes Forge Price, a proprietary pricing model for approximately 250 late-stage, venture-backed companies with secondary market liquidity. Forge Price underlies the methodology for identifying the Private Magnificent 7. The selection process for identifying the Private Magnificent 7 was based on a set of rigorous criteria, including company size, share price performance, secondary trading liquidity, market leadership, and brand equity. For more information, please visit this link.

Forge Price is also used to power Forge’s indices, which include the Forge Private Market Index, a first-of-its-kind benchmark for private market performance and the Forge Accuidity Private Market Index, which is tracked by the Accuidity Megacorn Fund. The Megacorn Fund adopts an index-based investment strategy to provide investors with low-cost, diversified exposure to late-stage, venture-backed companies.

About Forge

Forge is a leading provider of marketplace infrastructure, data services and technology solutions for private market participants. Forge Securities LLC is a registered broker-dealer and a Member of FINRA that operates an alternative trading system.

1https://www.mellon.com/insights/insights-articles/a-closer-look-at-magnificent-seven-stocks.html

2 Performance is based on Forge Price.

3 Performance calculated based on hypothetical portfolios of both the Public Magnificent 7 and the Private Magnificent 7 with modified capitalization weighting scheme capped at 30%. Public Magnificent 7 data is sourced from Nasdaq and Private Magnificent 7 data from Forge Data.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240911178458/en/