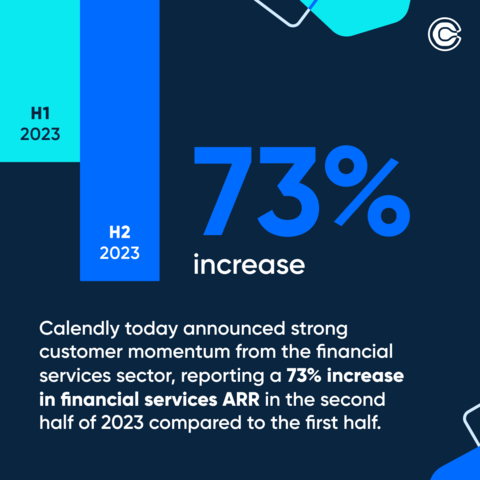

Calendly, helping individuals and teams schedule more productive external meetings and achieve faster business growth, today announced strong customer momentum from the financial services sector, reporting a 73% increase in financial services ARR in the second half of 2023 compared to the first half. Organizations like CI Assante Wealth Management, Mercer Advisors, Leader Bank, Buckingham Wealth Partners, The Federal Savings Bank, and Churchill Mortgage are using Calendly to deliver more seamless, personalized scheduling experiences and increase team efficiency.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240122406825/en/

(Graphic: Business Wire)

The financial services industry continues to undergo digital transformation as companies seek to meet evolving client and prospect expectations. Today, 14 of the top 15 Fortune 500 financial companies use Calendly. Over the last two years, meetings scheduled by financial services customers increased at a compound annual growth rate of 29% between 2021 and 2023. Calendly is seeing this growth across wealth and asset management, insurance, banking, and lending as these industries increase their investment in scheduling automation in order to better serve clients.

“Financial services organizations understand that strategy and technology go hand-in-hand, especially when it comes to closing productivity gaps,” said Jessica Gilmartin, Chief Revenue Officer at Calendly. “They’re turning to Calendly for secure, streamlined scheduling in order to win more clients, strengthen relationships, and improve efficiency to thrive in today’s market.”

Embracing scheduling automation as a business development solution

At financial services organizations such as Leader Bank, a Massachusetts-based national bank with a focus on residential home purchase lending, loan officers increasingly rely on new outbound and inbound business development techniques to engage prospective clients and retain customers.

“Before Calendly, it took about five emails to schedule every appointment. Fast forward since implementing Calendly, we’ve been able to create an always-on sales funnel while reducing inefficiencies within our business so our loan originators can focus on obtaining the best loans for clients,” said Eric Prue, First Vice President, Residential Lending Innovation at Leader Bank. “We always strive to put our clients first and present them with options that meet their specific needs.”

Leader Bank officers enable clients to self-serve and meet with the first available sales team member to discuss refinancing, home purchasing and/or pre-approval, and home equity line of credit. With Calendly, Leader Bank has saved $164,000 in costs over three years and regained 2,750 hours previously spent on admin tasks.

Meeting industry guidelines with security at the forefront

“The productivity tools rising to the top across the financial services industry are those that are efficient and understand user behaviors, while being backed by integrations and security; those are the ones that turn actions into dollars,” said John Spyers, Chief Information and Technology Officer at Buckingham Wealth Partners. “Calendly provides us with a competitive advantage in many ways by giving our clients easier access to advisors in the most secure manner possible.”

With more than 50 offices across the U.S. and managing and administering more than $63 billion in regulatory assets, Buckingham Wealth Partners uses Calendly to improve business performance across their sales and marketing team. The firm embedded Calendly into their website so prospects can conveniently and securely book a time to meet with the client and business development teams.

Calendly is one of the few scheduling platforms that helps customers minimize risk, adhere to SEC regulations, and meet security and compliance needs. Calendly follows FINRA guidelines, is ISO/IEC 27001 and SOC 2 Type 2 certified, and observes PCI and GDPR compliance. Customers can maintain records of outgoing communications sent from their Calendly account with communication archiving, and increase IT leaders’ and administrators’ oversight of scheduling in a secure, centralized manner with Calendly Domain Control to help protect their business, clients, and reputation.

Learn more about Calendly for financial services and read the blog post.

About Calendly

Calendly helps individuals, teams, and organizations globally automate the meeting lifecycle by removing the scheduling back and forth. Calendly enables companies to close deals, hire candidates, build relationships, and grow their business—faster. More than 20 million users across 230 countries use Calendly to simplify meetings and collaborate more effectively and efficiently. To learn more, visit Calendly.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240122406825/en/