Almost three quarters (73%) of American small business owners say their business has grown in the last year, with even higher percentages for Black (84%) and Hispanic (80%) owners, according to the U.S. Bank 2024 Small Business Perspective that was released today. The report, which is based on a survey of more than 1,000 small business owners, explores the complex challenges and stressors owners are facing in the 2024 macroeconomic environment, including efforts to retain and engage employees and the impact of artificial intelligence (AI) on operations and job security. The report also includes insights from small business employees to offer a holistic view of the small business landscape.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240823505000/en/

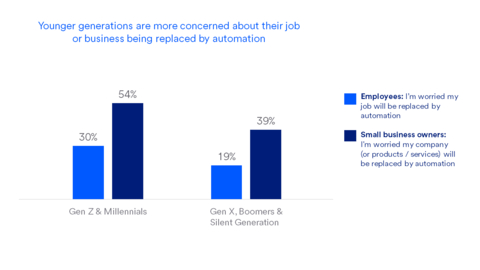

Gen Z and Millennial employees are 1.5 times more likely to feel worried about their job being replaced by automation than older generations. (Graphic: Business Wire)

According to the 2024 survey findings, many U.S. small business owners have been growing while also facing labor challenges, which include being understaffed (52%), navigating a more competitive labor market (77%), and struggling to increase their employees’ salaries to keep pace with inflation (65%). Survey data shows owners are taking several proactive steps to help their company attract and retain employees – such as the 83% who say they plan to offer flexible hours to support a healthier work/life balance.

At the same time, owners are embracing digital tools, with three quarters (75%) planning to focus on digital tools in the next 12 months to help reach their business goals. Small business owners are open to AI and automated solutions, with nearly 7 in 10 (68%) seeing their benefit, and 6 in 10 (60%) having already implemented a solution with AI or automation. However, they have some concerns (see visual) with 47% of owners being worried that their company could be replaced with automation.

“Small business owners continue to show resilience and optimism despite feeling impact from ongoing stressors such as the economy, changing labor market dynamics, higher prices and wages, and other macroeconomic factors,” said Shruti Patel, chief product officer for business banking at U.S. Bank. “The survey also reinforces the importance they place on digital tools in increasing efficiency and productivity. As small businesses owners rely more and more on software to manage their operations, U.S. Bank is focused on bringing our clients a seamless integrated experience across banking and payments to help streamline their cashflow and workflow.”

This survey includes input from 1,000 small business owners and 1,000 small business employees, as well as an additional sample of 300 Hispanic and 300 Black owners.

Small business owner top stressors and their impacts

Small business owners reported their top five macroeconomic stressors this year as:

- Competition (73%)

- Economic environment (71%)

- Inflation and the increased costs of materials/supplies (65%)

- Supply chain disruptions (47%)

- Obtaining enough funding to support their business (42%)

In an election year, almost a third (31%) of small business owners also ranked the political environment as a top stressor.

When considering the implications of their top stressors, nearly half (49%) said these factors were delaying their ability to grow their business at the rate they had wanted. More specifically, 48% of those who cited competition and 39% of those who cited supply chain disruptions as their top stressor said these were delaying their ability to grow. However, those who cited economic environment (53%) or inflation and increased costs (58%) as their top stressor said these factors were decreasing their revenue.

Digital tools and technologies: Embracing the future

Small business owners and employees understand the critical role digital tools play in enhancing their business success and efficiency. They also find AI and automated solutions to be an exciting prospect, but both have some apprehension.

About 7 in 10 (71%) owners and over half (55%) of employees agree that they need digital tools to make their jobs easier. When considering what they would like from a service provider, 8 in 10 owners prefer their bank to provide them with digital solutions for banking, payments, and other administrative tasks (79%), and say they prefer providers who can bundle the banking, payments, and operations digital tools they need (80%). When considering how they can best utilize digital tools, owners feel that they are most beneficial in simplifying their work so they can focus on growth (42%), preventing fraud (37%), and creating more efficient processes and improving overall productivity (36%).

While 68% of owners think AI and automated solutions are beneficial, nearly half (48%) of small business employees say there is lack of clarity on how automation will change the expectation of their job and one in four (25%) are worried their job could be replaced by automation. This increases for Gen Z and Millennial employees, who are 1.5 times more likely to feel worried about their job being replaced by automation than older generations (30% compared to 19% of Gen X, Boomers and Silent). Additionally, nearly half of owners (47%) are worried that their company will be replaced with automation. Despite hesitations, nearly 8 in 10 (79%) owners who don’t currently use AI say they are open to implementing AI and automated solutions in the next 12 months.

For an in-depth look at the insights of the nation’s small business owners and employees, please read the full 2024 U.S. Bank Small Business Perspective report.

Methodology

20-minute survey among 1,000 U.S. small business owners, 1,000 U.S. small business employees, plus additional over-samples of 300 Hispanic small business owners, 300 Black small business owners, and 200 small business owners from each of the following regions: Los Angeles County, Phoenix, Charlotte, and Minneapolis/St. Paul (Twin Cities). Owners were required to have an annual revenue of $25 million or less and between two and ninety-nine employees. Employees were required to work for a small business between two and ninety-nine employees. Fielding for this study was conducted from April 25, 2024 – May 20, 2024, and the margin of error is ±3.1% for the U.S. small business owners and small business employees, ±5.6% for Hispanic and Black owners, and ±6.9% regional owners.

About U.S. Bank

U.S. Bancorp, with more than 70,000 employees and $680 billion in assets as of June 30, 2024, is the parent company of U.S. Bank National Association. Headquartered in Minneapolis, the company serves millions of customers locally, nationally and globally through a diversified mix of businesses including consumer banking, business banking, commercial banking, institutional banking, payments and wealth management. U.S. Bancorp has been recognized for its approach to digital innovation, community partnerships and customer service, including being named one of the 2024 World’s Most Ethical Companies and Fortune’s most admired superregional bank. Learn more at usbank.com/about.

Disclosures: Deposit products are offered by U.S. Bank National Association. Member FDIC.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240823505000/en/