Vodafone Pay Can Make Contactless Payments From A PayPal Account

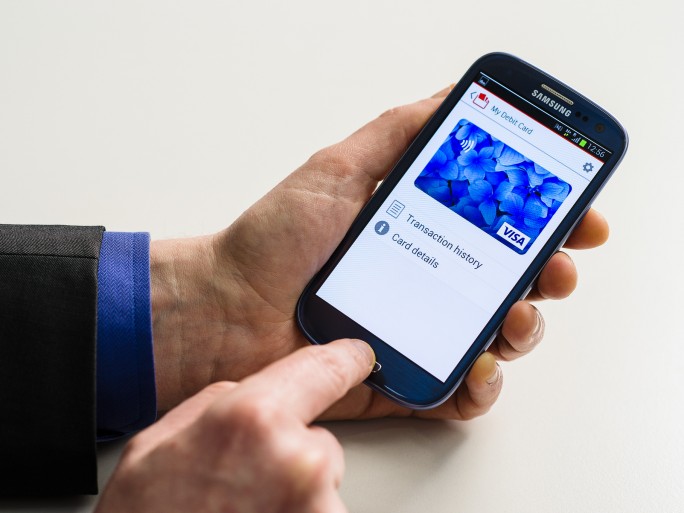

From today, Vodafone Pay users can add a PayPal account within Vodafone Wallet App and make contactless payments using Android smartphone

Vodafone Pay users can now make contactless payments on their Android smartphone using their PayPal account.

A PayPal account can be linked to Vodafone Pay using the Vodafone Wallet application, which also houses credit and debit cards, loyalty cards, coupons and vouchers. If anyone doesn’t have a PayPal account, they can sign up for one directly from within the app.

The Android Pay rival uses a contactless SIM for Near Field Communication (NFC) payments and can be used wherever contactless payments are accepted – even if the device has run out of battery.

Vodafone Pay

Vodafone hopes the contactless SIM, along with the added choice and security afforded by PayPal support, will encourage its customers to use the operator’s payment platform rather than Google’s own service or others like Samsung Pay.

Vodafone hopes the contactless SIM, along with the added choice and security afforded by PayPal support, will encourage its customers to use the operator’s payment platform rather than Google’s own service or others like Samsung Pay.

“Our customers told us that being able to use PayPal when making mobile payments was important to them so we’re delighted to now offer this on Vodafone Pay,” said Kate Wright, head of consumer services at Vodafone UK. “The service also works with any Visa and MasterCard credit or debit card offering customers greater choice than any other mobile payment service.”

“Money is going digital, and the smartphone is at the centre of this transformation,” added Rob Harper, director of mobile commerce at PayPal UK. “Mobile payments have long been at the heart of what we do. In fact, this year marks 10 years since we first launched a mobile payment service in the UK. As mobile technology continues to evolve, we will continue to look at new ways to make it easier and faster for our customers to pay.”

Find out more: Where next for the VPN?

Research from industry body The Payments Association suggests card payments will become more popular than cash in the UK within five years, thanks largely to the popularity of contactless transactions.

By 2021, card payments are predicted to reach 14.5 billion, overtaking the forecast 13.0 billion cash payments for the first time. And by 2025, notes and coins will drop to being used for just over one in four (27 percent) of payments, the report claimed.

Recent figures from Visa Europe found British consumers are the biggest users of contactless payments in Europe, making more than 153 million contactless transactions in the 12 months leading up to April 2016.

Are you a mobile payments aficionado? Take our quiz!