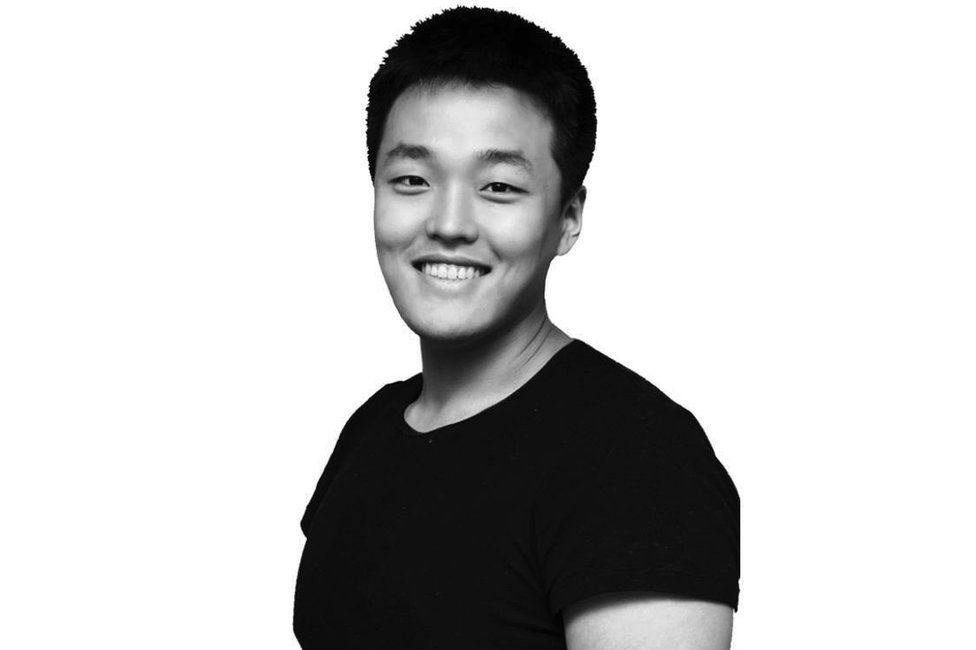

A US federal judge has ruled that a fraud trial by the Securities and Exchange Commission (SEC) against cryptocurrency issuer Terraform Labs and its founder Do Kwon can go ahead, denying the company’s motion to dismiss it.

US District Judge Jed Rakoff also said he disagreed with the reasoning of another judge who recently said crypto firm Ripple Labs was not necessarily offering securities in the form of its XRP token, in what was considered a significant ruling.

The SEC sued Terraform and Kwon in February for allegedly defrauding investors and violating securities law by selling billions of dollars in unregistered digital assets.

Terraform issued the TerraUSD “stablecoin”, intended to maintain a 1:1 peg with the US dollar.

Stablecoin collapse

It was the 10th biggest crptocurrency with a market capitalisation of more than $18.5 billion (£14bn) before its collapse in May 2022, when it abruptly lost nearly all its value.

In the lawsuit the SEC argued Terraform misled investors about the stability of TerraUSD and had claimed to investors that the tokens would increase in value.

Terraform Labs had claimed TerraUSD and companion token Luna were purchased for practical reasons and that investors did not consider them investments.

Rakoff rejected Terraform’s arguments and said that at this initial stage it must be assumed that it was true that, as the the SEC claimed, the company had “embarked on a public campaign to encourage both retail and institutional investors” to buy TerraUSD.

Ripple argument

He also rejected the argument of US District Judge Analisa Torres in the Ripple Labs case, in which Torres found Ripple’s XRP tokens did not necessarily constitute securities because people buying them could not necessarily know whether the seller was Ripple itself or a third party.

Rakoff said that whether the seller was Ripple itself or a secondary reseller “has no impact” on whether a reasonable investor would have an expectation of profit based on Ripple’s efforts.

The definition of cryptocurrencies as securities is key to the SEC’s current efforts to regulate digital assets under existing securities laws, and as such the Ripple ruling had been seen as a significant setback.