X Value Down By 79 Percent Since Elon Musk Purchase

X shareholder estimates value of firm formerly known as Twitter, is down nearly 80 percent since Elon Musk takeover

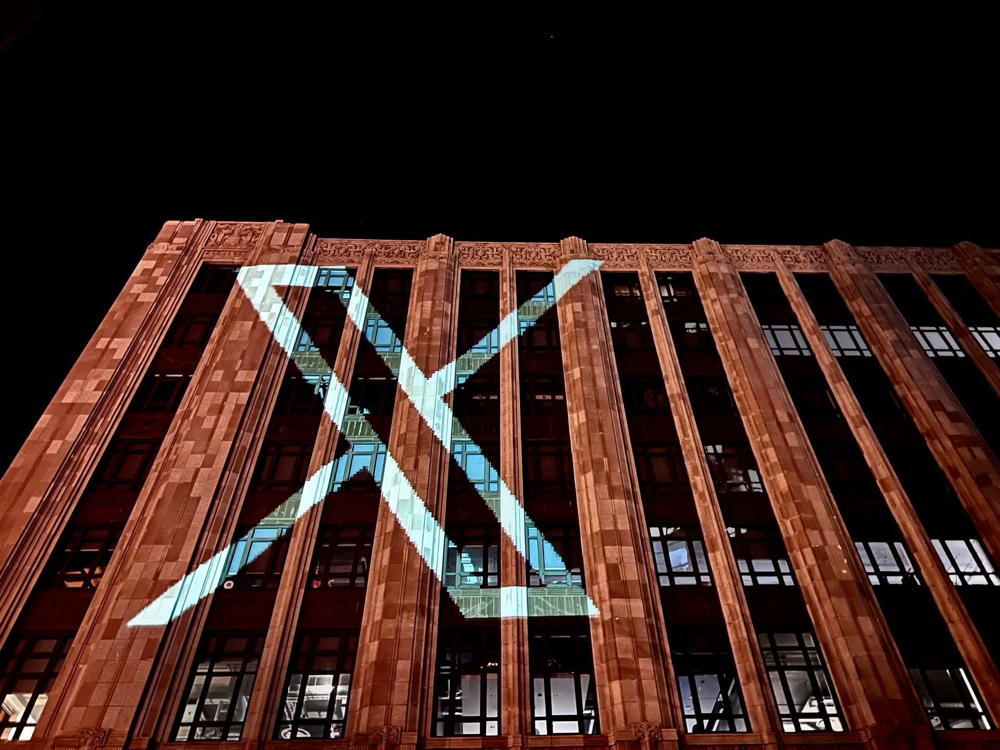

The estimated worth of the social media platform X (formerly Twitter) continues to decline under the ownership of Elon Musk.

CNN, citing estimates from investment giant Fidelity, reported that X is now worth almost 80 percent less than two years ago when Elon Musk finally concluded his controversial acquisition in late October 2022.

Musk’s acquisition had taken Twitter into private ownership, and the platform is no longer publicly traded or releases regulatory filings, so there are no official ways to gauge Twitter’s current market value.

Fidelity estimate

But Fidelity has a shareholding in the firm and regularly estimates what its stake in the firm is currently worth.

These estimates have been used as a closely watched barometer for the overall health of the company.

In June 2023 for example Fidelity had slashed its estimate of Twitter’s value, and suggested that Twitter had lost a staggering two thirds of its value since the Musk takeover.

Fidelity’s Blue Chip Growth Fund announced at that time that its stake in Twitter was worth $6.55 million, as of the end of April 2023. That is down from the $19.66 million the Fidelity fund said its stake was worth in October 2022 as Musk was finalising the acquisition.

Then in January 2024 Fidelity estimated that X had lost 71 percent of its value since it was bought by Elon Musk.

Fast forward to now, and Fidelity estimates that at the end of August 2024, those shares were worth just $4.2 million.

That new estimate marks a 24 percent drop in value from what Fidelity estimated as of the end of July 2024.

And it represents a staggering decline of 79 percent from the $19.66 million estimated in October 2022.

Other estimates

CNN noted that the new valuation from Fidelity implies that the investment giant believes X is now worth just $9.4 billion, which is a far cry from the $44 billion that Musk paid.

It should be noted that this is just an estimate by one investor, and other investors could value X differently.

CNN cited analysts as saying Fidelity’s plunging price tag for X likely reflects shrinking ad revenue at the company.

“Musk clearly overpaid for this asset,” Dan Ives, managing director and senior equity analyst at Wedbush Securities, told CNN in an email.

Ives is quoted as saying that he believes Twitter was really worth around $30 billion when Musk bought it, and today it’s worth closer to $15 billion. He said that while engagement on X is “strong,” ad pressure has persisted.