Taiwanese authorities have accused eight mainland Chinese tech firms, including chip equipment maker Naura Technology, of illegally poaching talent from the island amidst China’s semiconductor build-out.

Separately, chip industry association SEMI said China spent more on chipmaking equipment in the first half of the year than South Korea, Taiwan and the US combined, in another indication of the scale of mainland China’s efforts to build up an independent domestic chip industry.

Taiwan’s Ministry of Justice Investigation Bureau said on Wednesday it raided 30 locations and questioned 65 individuals in four cities, including Taipei and Hsinchu, over alleged talent poaching.

It said eight mainland Chinese companies were suspected of poaching talent and stealing trade secrets in Taiwan, which “seriously affects the competitiveness of Taiwan’s high-tech industry”.

‘Poaching’

It named the eight companies as Naura, iCommsemi, Shanghai New Vision Microelectronics, Nanjing Aviacomm Semiconductor, Emotibot, Tongfang, Chengdu Analog Circuit Technology and Hestia Power.

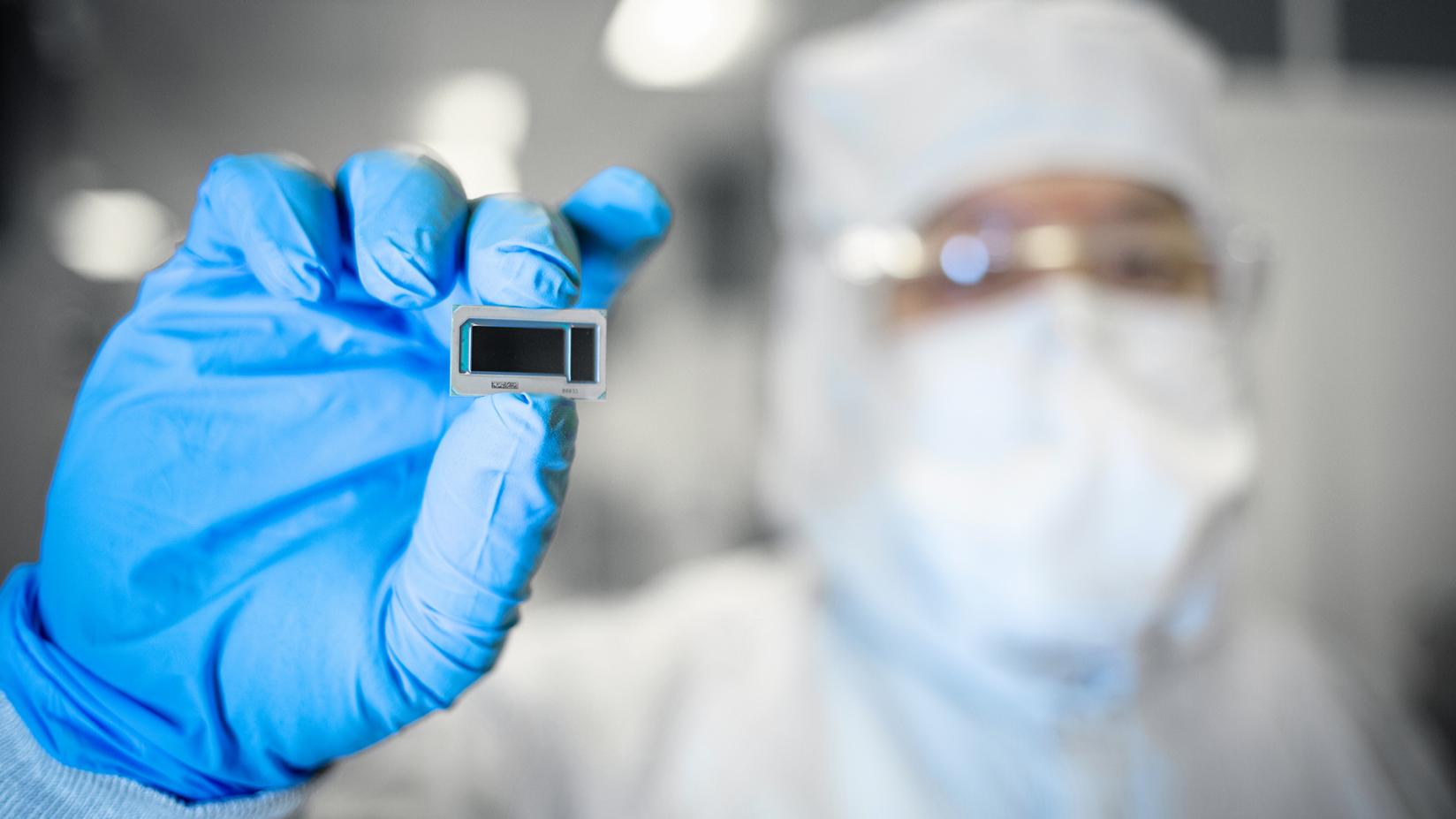

Naura, which makes etching, deposition and cleaning tools and other chipmaking gear, allegedly poached semiconductor equipment engineers in Taiwan.

Naura supplies to mainland chipmaking giants including Semiconductor Manufacturing International Corporation (SMIC), Yangtze Memory Technologies5B Corporation (YMTC) and Hua Hong Semiconductor Group.

The company has been increasing its efforts to develop high-end chipmaking tools after the US pressured the Netherlands and Japan to restrict chipmaking tool companies in the countries from selling advanced gear to China.

Naura denied poaching workers in Taiwan, saying in a statement its local office “was established and operates in accordance with local laws and regulations”.

Equipment sales

US and international sanctions spurred a frenzy of chipmaking gear sales to China in the first half of this year, as companies joined the government’s efforts to localise chip production and mitigate the risk of further restrictions, SEMI said.

China, the world’s biggest market for chip manufacturing equipment, spent a record $25 billion (£19bn) on chip tools in the first half, with spending remaining strong into July, indicating another full-year record spend could be on the way.

The country is also expected to be the biggest investor in constructing new chip factories, with spending expected to hit $50bn for the full year, including expenditures on chip tools.

SEMI expects significant annual spending growth in Southeast Asia, the Americas, Europe and Japan by 2027 as governments subsidise domestic chip manufacturing.

The industry body’s director of market intelligence, Clark Tseng, told Nikkei that Chinese companies were snapping up equipment for mature manufacturing processes, used to manufacture lower-end commodity chips, in the expectation that these could be hit by sanctions.

AI boom

Tseng said demand was being driven by larger companies such as SMIC as well as a significant number of smaller chipmakers.

China was the only country to increase year-on-year spending in the first half amidst a global economic slowdown, as Taiwan, South Korea and North America all reduced year-on-year expenditures.

The chip industry has grown roughly 20 percent this year so far largely due to returning demand for memory chips and a surge in demand for AI chips, SEMI said, with sectors such as automotive or industrial chips showing only 3 to 5 percent growth.

Tseng said SEMI expects another year of 20 percent growth in 2025 due to the same drivers.

China was the biggest revenue source for the top chipmaking equipment providers, making up 49.9 percent of the revenue for the June quarter of Japan’s top toolmaker Tokyo Electron, and 49 percent for the Netherlands’ ASML.

US chipmaking equipment providers Applied Materials, Lam Research and KLA said they made 32, 39 and 44 percent of their revenues from China in their latest quarterly results.

All of those companies are subject to US-led export controls that restrict them from selling their most advanced gear to China.