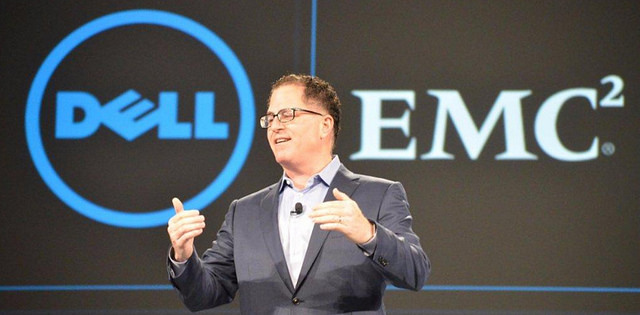

What’s Really Happening Inside The Dell, EMC Merger

ANALYSIS: As the merger chugs to its conclusion, employees fret for their jobs, China is causing ire and lot of corporate wrinkles need to be ironed out

If you ask any of the top brass at either Dell or EMC, they are all well-rehearsed in telling you that everything is perfectly “on track” and “in order” in bringing two of the world’s largest and most successful IT hardware/software vendors together under one corporate roof by next fall.

To that we say, “Thank you very much, and, by the way, nice try.” Our reaction, along with a lot of people to whom we spoke at the recently concluded EMC World 2016, is quote, “Bull Pucky,” unquote.

Mergers, especially those of this scale, cannot zoom along as if on rails. This is patently impossible. Two giant Tyrannosaurus rexes who have been gobbling up other animals and companies for years — and bloodied each other in some big fights in the storage markets — could hardly step politely onto the same container ship and sail off into the sunset as BFFs. Ask AOL and Time Warner, Hewlett-Packard and Compaq, and Oracle and Sun Microsystems if you don’t believe this.

Friction is Carefully Hidden

There is friction wherever one looks at Dell and EMC. There are simply too many proprietary charging plugs and codebases that don’t fit or don’t work together. There are too many national and foreign regulators to satisfy, especially in China at this time. There are too many overlapping product lines, too many similar jobs, too many sales people competing with each other, and too many redundant solution partners.

There are too many clashing marketing people, quizzical and dissatisfied EMC investors and too many prickly C-suite egos to make this $67 billion business deal merely a sweet bedtime story.

There is not enough of a cloud strategy within these two companies to make a dent in the huge market now controlled by Amazon, Google, Microsoft, Oracle and others. Dell has had some early success with Dell Cloud, and EMC has Virtustream, which is a promising service, but it is unproven. This is a concern that will have to be addressed.

There is not enough of a cloud strategy within these two companies to make a dent in the huge market now controlled by Amazon, Google, Microsoft, Oracle and others. Dell has had some early success with Dell Cloud, and EMC has Virtustream, which is a promising service, but it is unproven. This is a concern that will have to be addressed.

Don’t forget the cost of this merger. Dell is trying to decide which divisions to cut and which to keep going forward; this is always a pain point. The latest worry is whether Dell should sell off its software (the former Quest Software, which it bought for $2.3 billion in 2012) and security (SonicWall) franchises. Thousands of employees are fretting those decisions.

Dell May Sell Bonds to Cover Bank Debt

That’s certainly not all; Dell apparently is going to have to sell bonds to help cover the debt it is incurring.

That’s just great. Remember, Dell went private in 2013 and is taking EMC private, so this is akin to selling stock: Dell is ostensibly planning to cover $24 billion of its $49.5 billion bank debt with corporate bonds. This is hardly an exemplary way to baptize such a massive new company and send it back into the world.

So forgive us if we don’t entirely believe the narrative that everything is peachy. Remember, this is an election year, and skepticism is high on the agenda everywhere.

Not all the data points in the merger are questionable. There are some interesting parallels between these two companies, and they see the global IT markets in similar ways.

Both have been very successful in selling IT hardware. Both were founded the same year, 1984; one in the suburbs of Boston and the other in a dorm room at the University of Texas in Austin. Both were both started by forward-looking men with progressive ideas about IT hardware: Dell in personal computers and EMC in enterprise data storage.

Both have been very successful in selling IT hardware. Both were founded the same year, 1984; one in the suburbs of Boston and the other in a dorm room at the University of Texas in Austin. Both were both started by forward-looking men with progressive ideas about IT hardware: Dell in personal computers and EMC in enterprise data storage.

Dell, EMC, Share ‘Buy vs. Build’ Approach

Both companies have been developed largely on the strategy of buying intellectual property in lieu of developing it in house, although both have created their own IP over time and been investing more capital into home-grown products lately.

Both have been very successful at identifying talent elsewhere and bringing it inside their own firewalls. VMware, RSA Security and Pivotal are merely three good examples for EMC, and Compellent, EqualLogic and Boomi have been three of the many clear-cut successes acquired by Dell.

These certainly are not dunderhead enterprises. EMC was very good at playing hardball with its installed base, second only to Oracle in the manner in which it twisted arms to wring out additional sales each quarter. Make no mistake about it: EMC was extremely successful in storage sales, recording some nine years of double-digit sales growth and leading the world for more than a decade in external storage hardware and software markets.

Dell has been among the top five sellers of personal computer sales for a generation. It has been growing its enterprise servers, storage and networking businesses for nearly a decade, and it’s working hard to establish itself as an enterprise cloud infrastructure provider.

Now, as they proclaimed last Oct. 11, the two IT giants will continue their relationship as a married couple, with the wedding apparently set for this next October.

Originally published on eWeek.