SEC Reaches $4.5bn Settlement With Bankrupt Terraform Labs

Terraform Labs and disgraced founder Do Kwon agree to pay the US SEC a combined $4.5 billion in civil fraud case

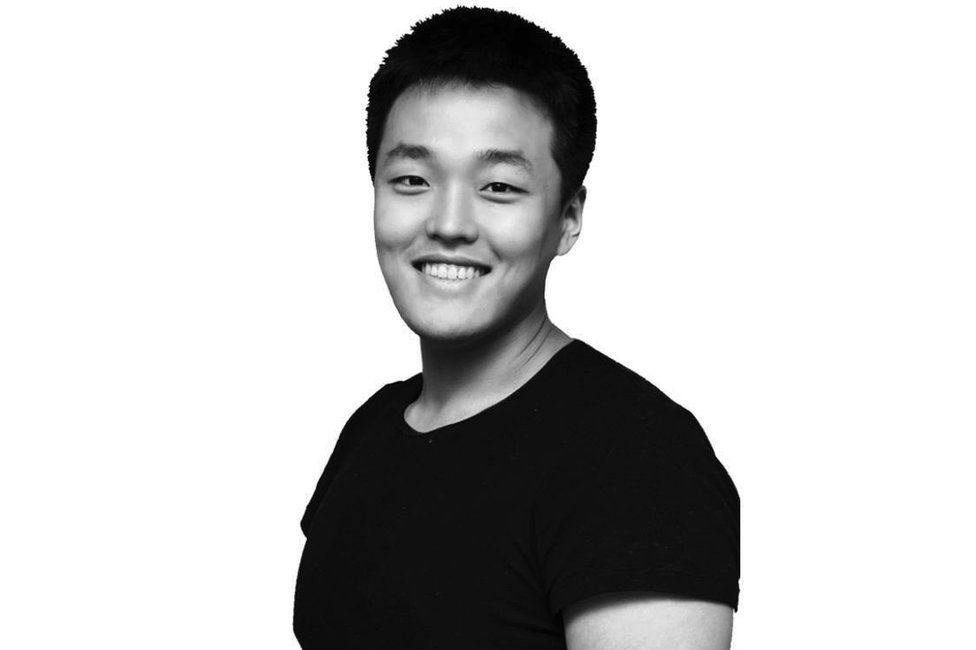

Settlement terms have emerged between the US Securities and Exchange Commission (SEC) and collapsed crypto company Terraform Labs, as well as its disgraced founder and former CEO Do Kwo.

The settlement, which has still to be approved by a US judge, will see Terraform Labs and Do Kwon paying a combined $4.47 billion in disgorgement and civil penalties, Reuters has reported.

It comes after Terraform Labs and its Do Kwon had last month reached a tentative settlement with the US SEC, but settlement terms were not revealed at that time.

SEC settlement

In February 2023 the SEC had charged Singapore-based Terraform Labs PTE Ltd and Do Kwon with orchestrating a multi-billion dollar crypto asset securities fraud that lead to the 2022 collapse of the $40 billion digital asset project – which included the stablecoin Terra and its sister token Luna.

In December last year a US federal judge ruled that Do Kwon and Terraform Labs had violated US law by failing to register the two digital currencies that had collapsed in 2022.

A trail against Do Kwon and Terraform Labs began in New York on 26 March 2024, and concluded in April, when both were found liable on civil fraud charges.

The civil fraud trial saw a Manhattan jury conclude that both had misled investors about the stability of their so-called “algorithmic” native stablecoin, Terra USD (UST), and the use cases for the Terra blockchain.

In April the SEC had asked US District Judge Jed Rakoff in Manhattan to impose $5.3 billion in fines on Terraform Labs and Do Kwon.

Now the settlement reached between the SEC and Terraform Labs and Do Kwon was filed on Wednesday in Manhattan federal court.

It requires approval by Judge Jed Rakoff.

Terraform’s judgement reportedly includes $4.05 billion of disgorgement plus interest, and a $420 million civil fine.

How much of this will actually be handed over remains to be seen, as Terraform filed for bankruptcy in January. Reuters reported the debt will instead be treated as an unsecured claim in the Chapter 11 case, where Terraform is liquidating.

The total judgement is $4.55 billion, including an $80 million civil fine for Kwon, Reuters noted. He agreed to be banned from crypto transactions, and is required to transfer $204.3 million to Terraform’s bankruptcy estate.

“Entry of this judgement would ensure the maximal return of funds to harmed investors and put Terraform out of business for good,” the SEC reportedly said in a court filing. “Thus, this proposed judgement is fair, reasonable, and in the public interest.”

Terraform and Kwon consented to the judgement. Their lawyers did not immediately respond to requests for comment, Reuters reported.

Protracted case

It is thought that nearly 250,000 people had invested in Terraform Labs’ coins, and blockchain analytics firm Elliptic estimated that investors in TerraUSD and Luna lost an estimated $42 billion – a far bigger number than the recent trial of FTX’s Sam Bankman-Fried.

Do Kwon continues to face significant legal problems after South Korea issued an international arrest warrant, and Interpol issued a “red notice” for his arrest.

After months of searching Do Kwon was eventually arrested in Podgorica, the capital city of the Balkan country of Montenegro in March 2023.

Kwon and a second person identified as Han Chang-joon, Terraform Labs’ former finance officer, had been arrested when they tried to board a flight to Dubai.

Do Kwon has been held in custody there pending his extradition to either South Korea or the United States, where he is to face criminal charges.