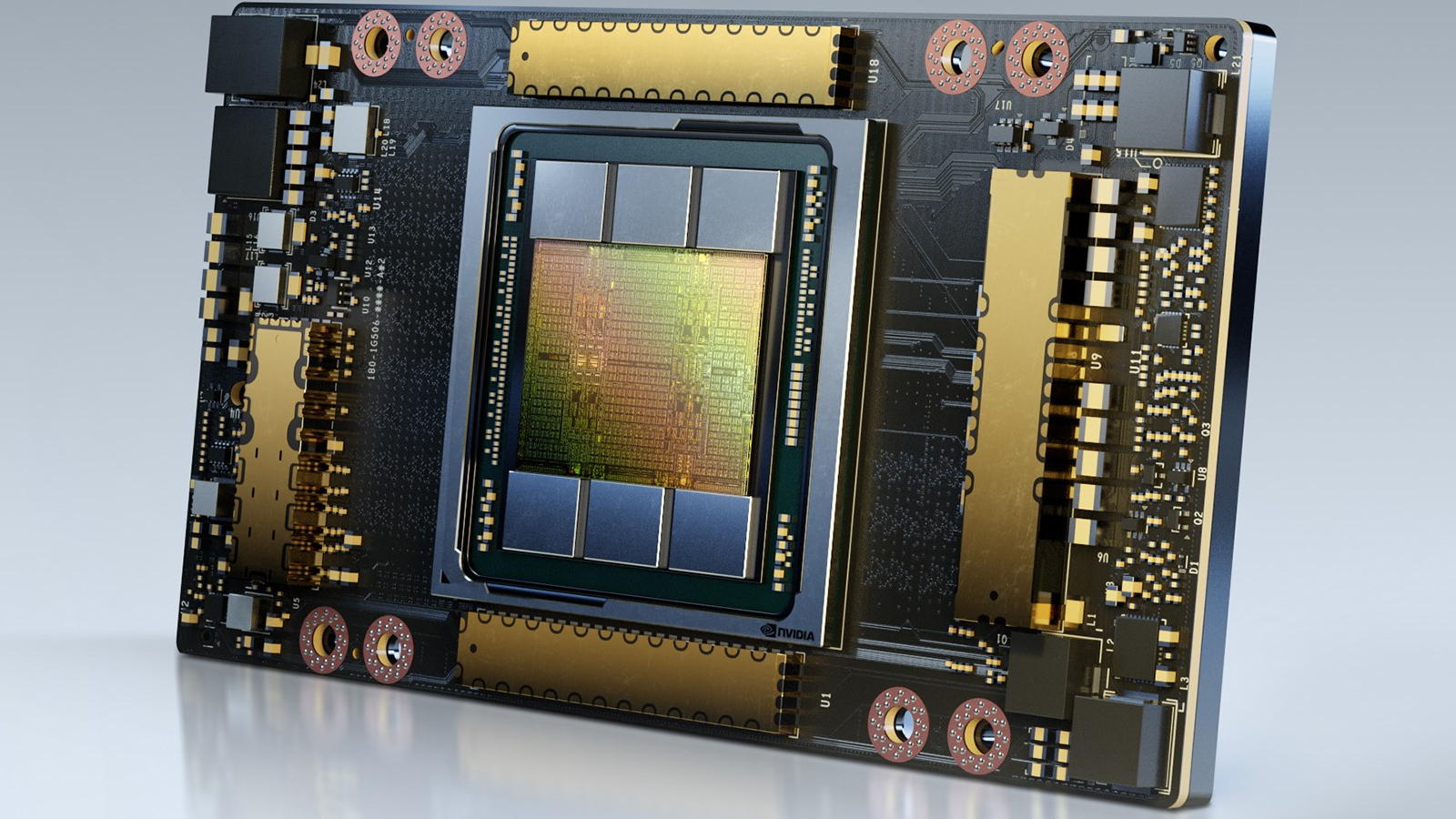

Nvidia is planning to begin mass production of its latest artificial intelligence (AI) chip aimed at the China market in the second quarter, but is already facing reduced demand from the country’s biggest cloud providers over regulatory uncertainties and the product’s reduced performance, according to reports.

The US has so far targeted China with two rounds of sanctions in October 2022 and October 2023 that specifically limit the parameters of AI chips that domestic firms such as Nvidia can sell to Chinese buyers.

The US Commerce Department has additionally made it clear that it plans to continually review what it allows to be sold to China in order to throttle the country’s AI industry.

“If you redesign a chip around a particular cut line that enables (China) to do AI, I’m going to control it the very next day,” US commerce secretary Gina Raimondo said in a speech last month, in which she called China the “biggest threat we’ve ever had”.

Domestic competitors

The continually changing regulatory parameters have required Chinese cloud companies buying Nvidia’s chips to go through an expensive process of adapting their technology to new chips each time Nvidia’s lineup changes, the Wall Street Journal reported.

And each time Nvidia downgrades the speed of what it offers in China the performance gap with locally sourced alternatives grows narrower.

As a result cloud giants Alibaba Group and Tencent have both told Nvidia they plan to buy far fewer Nvidia chips this year than they had originally planned when now-banned chips were available, the paper said, citing unnamed sources.

The two companies have shifted some orders to domestic firms such as Huawei and are also developing their own chips in-house, the paper said.

Buying patterns

It added that the country’s other two top AI cloud chip buyers, AI pioneer Baidu and TikTok owner ByteDance, were similarly shifting their buying patterns. China’s biggest cloud companies have been testing Nvidia’s samples since November, the paper said.

Reports last month had said Huawei, Tencent and smaller Chinese start-ups were seeing increased interest in their Nvidia alternatives.

“The (United States’) original goal was to slow down China’s AI capabilities but, in fact, related action has boosted China’s self-development capability,” said Nori Chiou, investment director at White Oak Capital, at the time.

The moves may mean trouble for Nvidia in the longer term, as companies are modifying their business strategies for a future with reduced access to Nvidia’s chips.

Next-generation launch

Historically China has accounted for about one-fifth of Nvidia’s revenue, although this spiked last year ahead of expected new sanctions.

Nvidia currently provides about 80 percent of the high-end AI chips used by Chinese cloud companies and this could decline to 50 to 60 percent, according to TrendForce projections.

Nvidia has said it does not expect any short-term financial impact from restrictions on selling its AI chips to China because it can find other buyers for them.

The company’s latest China-focused AI chip, the H20, is set to begin mass production in the second quarter of 2024 after having been delayed from a November launch due to issues server manufacturers were having integrating it, Reuters reported.

Increasing restrictions

Reuters’ sources said Nvidia is planning limited initial production and, similar to other reports, said Chinese firms are testing domestic alternatives because they fear new restrictions could bar access to the latest chips.

In addition to the H20 Nvidia is also reportedly planning two other less-powerful chips, the L20 and L2, that also comply with US sanctions.

Last year’s sanctions blocked Nvidia from selling the A800 and H800 chips to China after Nvidia had specifically designed those two processors to comply with earlier sanctions.