SK Hynix To Invest $6.8bn In Yongin Memory Chip Plant

SK Hynix to invest $6.8bn in first plant in emerging chip hub of Yongin amidst soaring demand for memory used in AI processors

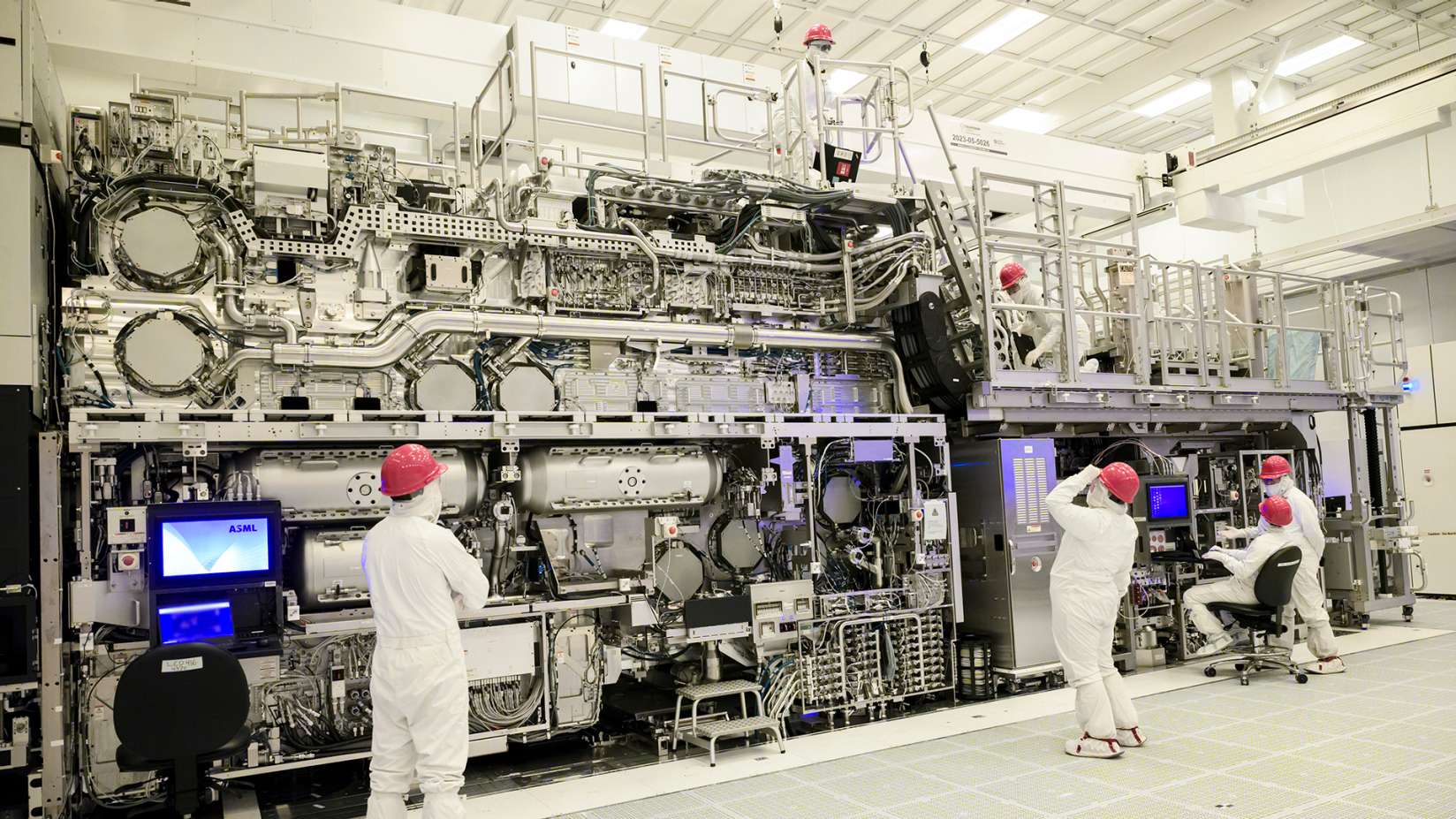

Memory giant SK Hynix said it plans to invest about 9.4 trillion won ($6.8bn, £5.3bn) in its first plant in the city of Yongin, an emerging chip hub just south of Seoul where the government is pushing the construction of a massive complex of semiconductor-related businesses.

Construction is set to begin in March of next year in the Yongin Semiconductor Cluster with the project to be complete by May 2027, the company said.

“The Yongin cluster will be the foundation for SK Hynix’s mid- to long-term growth,” said head of manufacturing technology Kim Young-sik.

The company said in a regulatory filing the investment was a response to demand for AI chips and aimed to secure future growth.

Semiconductor complex

Earlier this year SK Hynix committed 120tn won to build four fabrication plants, or fabs, in the cluster, with the other three planned for a later date.

The company’s 4.2 million square metre site in Yongin is intended to house all for fabs as well as more than 50 small local firms in the chip industry, SK Hynix said.

The aggressive investment is an indication of the determination of SK Hynix and the South Korean government to maintain the country’s lead in memory chips, which are a critical component of artificial intelligence (AI) processors.

Samsung and SK Hynix, the worldwide No. 1 and No. 2 memory manufacturers, are both based in South Korea and are both suppliers of high-bandwidth memory to AI chip leader Nvidia.

Last Thursday SK Hynix reported second-quarter profits that were its highest since 2018 due to strong demand for AI infrastructure.

Last month South Korea said semiconductor firms’ inventories fell in April by the largest amount since 2014 in the latest sign of how demand for generative AI infrastructure is driving chip sales.

AI chip demand

Inventories declined by 33.7 percent in April over a year earlier in the largest drop since late 2014, according to data from South Korea’s national statistical office.

April marked the fourth month of declines in inventories, a sign that demand is outstripping companies ability to supply it.

South Korean president Yook Suk Yeol last year told a meeting of government officials and business executives that geopolitics had turned chip competition into an “all-out war” .

In May China launched its biggest-ever investment fund for the country’s domestic chip industry, valued at 344 billion yuan ($47.5bn, £37bn) as it continues its drive toward semiconductor self-sufficiency, including a massive ramp in memory chip production by companies such as YMTC that mostly supply chips to domestic firms.